follow our taste makers series on instagram In 1504, Isabella d'Este stood before yet another failed commission. The painting was technically perfect, every brushstroke precise, ev…

Sven

Latest on ideas.sven.cv

Jun 16, 2025

Jun 5, 2025

Tomorrow, work will wake before you do. Not because an alarm rings, but because the code you wrote last night will already be revising itself, an autonomous agent tightening produc…

Dec 16, 2024

On a quiet Sunday morning, I step outside for my long run, headphones on, and press play. Queen’s iconic question fills the air: Is this the real life, or is this just a fant…

Recent Work

2024 — Now

Amsterdam

2023 — Now

Product designer at Try Nothing

Try Nothing

2022 — 2023

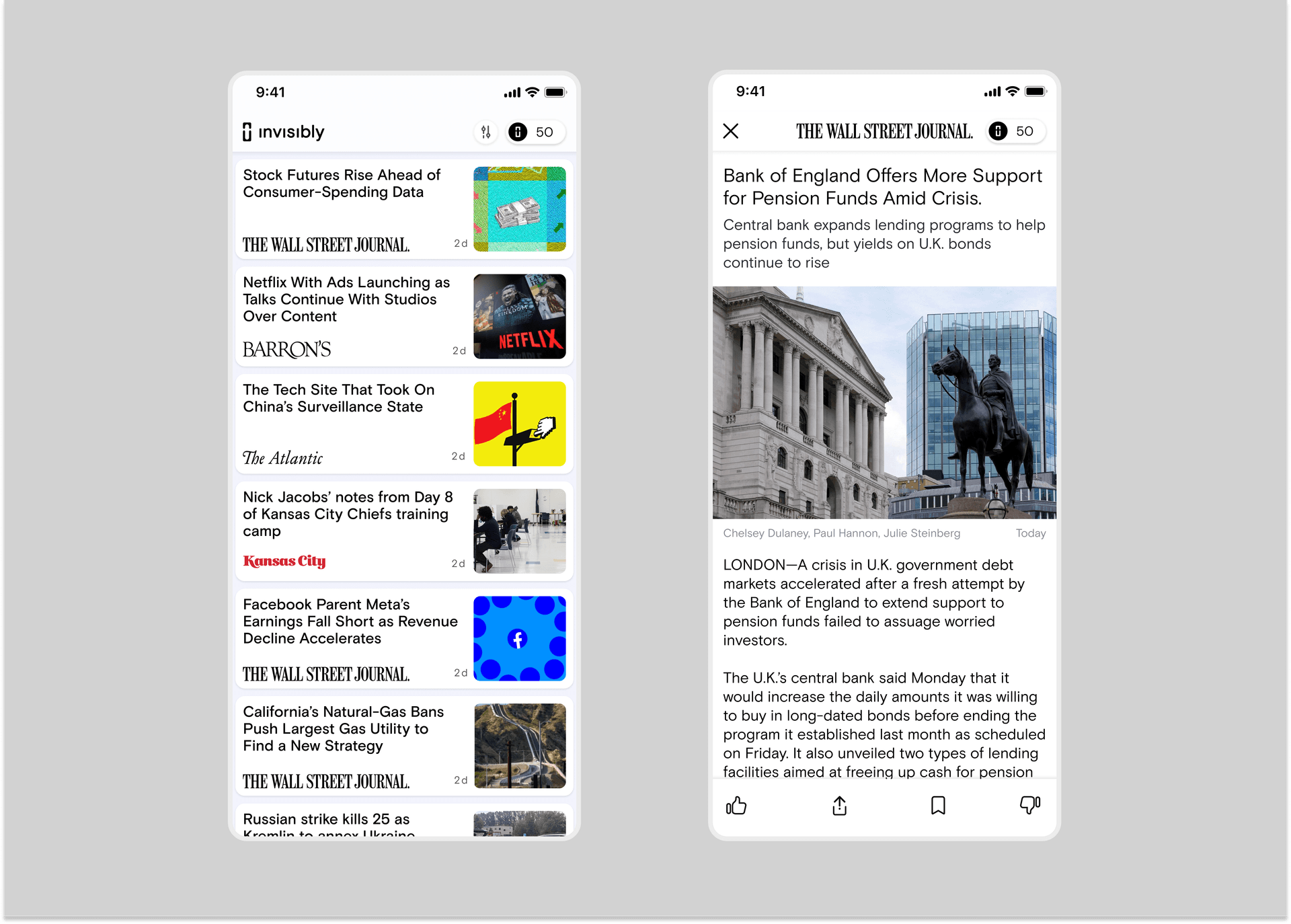

Lead Product Designer at Invisibly

Remote

Projects & Experiments

2023

Hey Mind AI (v1)

2020

Education Redesigned at Señor Wooly

Señor Wooly

2021

Explore web3 at upupland

upupland

2018

Design E-learning platform at Señor Wooly

Señor Wooly

From the Past

2013 — 2022

2016 — 2019

Creative Director at CloudsWork

Amsterdam

Creative Director of e-commerce agency building b2b and b2c webshops.

2010 — 2013

Co-Founder at Perlude

Wilnis

Design studio of two building websites and brands for small businesses.